-

13 years

A strong track record on the markets

-

10

Asset classes

-

135,000+

Daily executed trades

-

950+

Tradable Assets

CFDs on Currencies

The Forex market is the world's largest market for currency trading. Forex CFDs allow investors to trade on currency price movements without owning them.

CFDs on Indices

Indexes, like the S&P 500 and NASDAQ, serve as benchmarks to track the performance of a market or an asset class. CFDs on indexes enable trading on these benchmarks without owning the actual stocks.

CFDs on Commodities

Commodities are raw materials, e.g., gold and oil. CFDs on commodities let investors trade on price movements without holding the items.

CFDs on Stocks

CFDs on stocks let traders trade on company share price movements without owning the shares.

CFDs on ETFs

ETFs are baskets of investments such as stocks or bonds. CFDs on ETFs allow investing in the ETFs’ prices without owning the ETF shares.

CFDs on Crypto

Cryptocurrencies, like Bitcoin, are digital assets. CFDs on crypto allow investors to gain exposure to crypto prices without holding the coins.

Top trading instruments

| Trading pairs | Last price | Bid | Ask | Changes | Charts | Action |

|---|

*Information regarding past performance is not a reliable indicator of future performance. Leverage restrictions may apply depending on the client’s circumstances and/or jurisdiction. You need to be aware that losses can be magnified due to the leveraged nature of the relevant products.

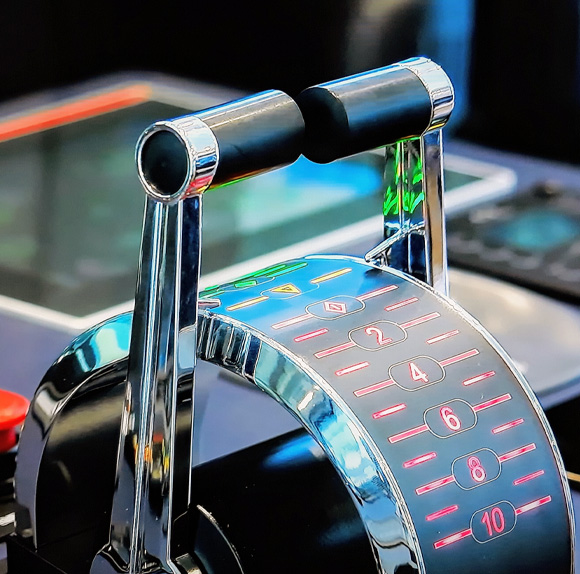

MT5: gold industry

standard

Advanced trading features - all in one platform

-

Web Application

A comprehensive trading experience on your computer. Maximum functionality and convenience. -

Desktop Version

Easy access right from your browser. Trade without downloading additional software. -

Mobile Version

Trade on the go with the adaptive mobile version of the site. Always stay updated with market news.

FAQ

-

What is a CFD?

A CFD, or Contract for Difference, is a financial contract that allows traders to get exposure on a price movement of an asset without actually owning it. It's an agreement between a trader and a broker to exchange the difference in value of an asset from the time the contract is opened to when it's closed.

-

How does CFD trading work?

When you trade CFDs, you're speculating on the future price movement of an asset, whether it's going up or down. If you believe the price will rise, you 'buy' or 'go long'. If you think it will fall, you 'sell' or 'go short'. Profits or losses are realized based on the difference between the opening and closing prices.

-

What assets can I trade with CFDs?

CFDs cover a wide range of markets, including forex, stocks, indices, commodities, and cryptocurrencies.

-

What are the advantages of CFD trading?

CFD trading offers several benefits:

- Leverage, allowing you to control a larger position with a smaller capital outlay.

- The ability to profit from both rising and falling markets.

- No physical ownership of the asset.

- Access to a wide range of markets from a single platform.

-

Are there risks associated with CFD trading?

Yes, CFD trading carries risks. The use of leverage means that both potential profits and losses are magnified. It's essential to have a risk management strategy and to only invest money you can afford to lose.